does colorado have inheritance tax

Probate The legal process in which the distribution of property is overseen by a court after the death of the owner. Maryland is the only state to impose both.

Estate Taxes And Overall Federal Revenues High Country Capital Management Www Hccm Com Estate Tax Inheritance Tax Estate Planning

Twelve states and the District of Columbia have estate taxes as of 2022 but only six states have an inheritance tax Maryland has both taxes.

. All of your property is totaled at its fair. This is not a loan as we are paid directly out of the estate and the remainder of your inheritance goes straight to you. There is no estate or inheritance tax in Colorado.

Tax is tied to the federal state death tax credit to the extent that the available federal state death tax credit exceeds the state inheritance tax. 9117 amended December 23 2003. The recoupling does not affect the.

In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. When it comes to inheriting assets it is important to have an understanding of the terms below. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as.

Beneficiaries Heirs and Inheritors The terms used to refer to an individual or group of individuals who can legally inherit according to the law or a will. Taxes at the Federal Level. Impose estate taxes and six impose inheritance taxes.

There is no obligation. Instead it has an estate tax. Most capital gains in Colorado are taxed at the standard income tax rate of 450.

The estate tax is a tax on the right to transfer property at your death. However certain long-term gains are exempt. You can use the advance for anything you need and we take all the risk.

The federal government doesnt have a specific inheritance tax. If your probate case does not pay then you owe us nothing. Pennsylvania had decoupled its pick-up tax in 2002 but has now recoupled retroactively.

Colorado Capital Gains Tax. Twelve states and Washington DC. Gains from property acquired after May 9 1994 which was held for at least five years before being sold may be exempt up to a limit of 100000.

Your credit history does not matter and there are no hidden fees.

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

Colorado Estate Tax Everything You Need To Know Smartasset

Colorado Estate Tax Everything You Need To Know Smartasset

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

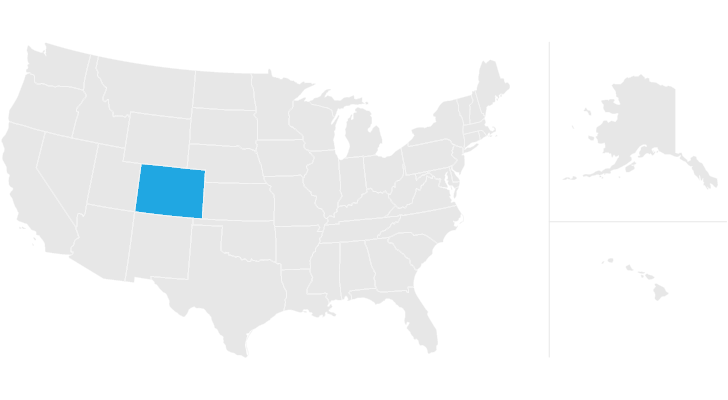

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States That Won T Tax Your Retirement Distributions Retirement Money Retirement Retirement Income

Mcleod County Minnesota Treasurers Office Tax Receipts From Etsy Estate Tax Minnesota Tax Payment